Accounting corporate cards: settlement procedure

Bank corporate card, as you know, are universal. Therefore, calculations with them today received widespread. Corporate cards are convenient to use as travel around the country and abroad, with the payment of hospitality services, the receipt of cash in the outlets and ATMs. The article will look at how are corporate accounting.

General rules

To obtain a corporate card, the company signed a contract with the banking structure. This opens a special Bank account. The amounts that appear on it, recorded at MF. 55.

To reflect the funds available on the enterprise map the enterprise accounting uses a special sub-account to the account 55.

Particularly analysts

Construction of analytical accounting is carried out depending on the conditions of use of the card.

In some cases, the agreement with the Bank provides for the presence on account of the security Deposit. It represents the minimum amount residing in the account. It is also called the minimum balance. This amount can be spent in exceptional cases. The Deposit, in particular, is used in the case of exceeding the payment limit.

In accounting, corporate cards of legal entities, it is expedient to open the subaccount of the 2nd order to a CQ. 55. It can be subsc. "Payment limit" and "security Deposit".

These sub-accounts in accounting, corporate cards of legal entities is displayed without fail, if a single company account tied to multiple cards, using which any holder may perform payment transactions within the specified limit. When depositing funds, the client sends to the Bank statement with the data holders and card numbers, amounts that should be transferred to each of them.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Reflection of enrollment

When replenishing the settlement account corporate card accounting entry is made:

- DB midrange. 55 subsc. "Special account" KD CQ. 57 "current account" (52 "Currency account").

In respect of foreign currency in the special account shall be revalued on the date of transaction and day reporting. Exchange rate differences in accounting, corporate cards are recognized as:

- DB midrange. 55 subsc. "Special account" KD 91 subsc. "Other income" (the sum of positive differences);

- DB midrange. 91, subsc. "Other expenses" CD CQ. 55 subsc. "Special account" (for negative differences).

"Transfers in transit"

Upon receipt by the Bank source documents, that the transactions under the corporate card settlement account in accounting records.

DB midrange. 10 (20, 25, 26, etc.), CD CQ. 57 "Transfers in transit".

The Use of 57 accounts is due to the fact that the primary documents (receipts, slips, etc.) this Department receives and processes up to the formation of statement on card account, confirming write-off of assets.

For this account you must open a special sub-account. It will reflect the calculations for the corporate card.

In accounting, operational control of the balance of funds can be made by subtracting the amount on subsc. "Operations on card accounts" (to Sch. 57) from the balance of the subaccount "Special account" (to Sch. 55).

Transactions

It is implemented after receiving the Bank statement, which is confirmed by the actual cancellation. In accounting operations, corporate cards are recorded as follows:

- DB midrange. 57 subsc. "Operations on special accounts" KD CQ. 55 subsc. "Special account".

The list of operations allowed for implementation, specifies that the holder is entitled not only to payment but to use it to obtain cash.

Cash Withdrawal from corporate card accounting is made on the basis of supporting documents. They are issued at the point of delivery or at the ATM. Wiring will be like this:

- DB midrange. 71 KD CQ. 57 subsc. "Operations on special accounts" (in the amount of funds received).

The Use of cash is reflected in General rules in accordance with the primary documents enclosed to the expense report of the employee.

Important point

In addition to the above model, document flow and accounting for corporate cards, in practice, a situation may arise when the employee did not provide primary or other supporting transaction documentation during the reporting period. The Bank statements may reflect charges.

In such situations, it is necessary to proceed from the following. Each card is assigned to a certain person – holder. According to the procedure of reporting on the movement of funds on the special accounts, they must state the card number with which to make the cancellation. In such a situation demonstrated the value of competent analysts of the organisation on account 55.

Withdraw funds from corporate Bank cards in the accounting records is carried out on the basis of the statement, not documented, and is reflected as follows:

- DB midrange. 73 KD CQ. 55 subsc. "Special account".

If the holdermaps do not provide source documentation or the expenses made, will not be considered economically justified, he must return the disbursed funds according to the established rules. The reflection of the refund loan CQ. 73 in correspondence with the items of assets of the company (for example, MF. 50, 51).

Accounting of operations in foreign currency

The Specifics of accounting on corporate credit cards foreign currency is determined by the conditions of its cancellation and conversion under a financial institution. In addition, the importance is the look of the card.

According to the General rules, after returning from abroad, the traveler is the advance report, which is dealing in accounting. It offers primary documentation. In its composition, among others, the paper made a payment.

All the expenses in foreign currency must be converted into rubles on the day of approval of the report. While compiled records:

- DB midrange. 08 (26, 44) CD CQ. 71 (in the amount of the ruble equivalent of the expenses at the exchange rate);

- DB midrange. 71 KD CQ. 57 subsc. "Operations on special accounts" (expenses paid with the card, in rubles at the exchange rate).

Further entries depend on what kind of (currency or ruble) using the corporate card. In accounting, transactions in foreign currency debt on Sch. 57 shall be reassessed Yes the day they are made. When you receive a Bank statement is a record:

- DB midrange. 57 subsc. "Operations on special accounts" KD CQ. 55 subsc. "A special account in the Bank" – ruble equivalent at the exchange rate on the day the charge is made.

Together with that of the MF. 57 determine the exchange difference. It relates to the credit or debit Sch. 91 (depending on the nature of course corrections).

When using the ruble corporate accounting the recording will be made in an amount in rubles, specified in the statement. Usually its value is different from that which is reflected on Sch. 57 subsc. "Operations speckart" on the day of approval of the report. This is because the financial structure used in revaluation of foreign exchange transactions internal rate not matching the rate of the Central Bank.

The variance is considered as the amount. Since the size of the payment that is made in rubles in the amount corresponding to the amount of foreign currency, adjusted for differences, they are reflected on the same account as the size of travel cost. This can be a CQ. 08, 44, 26, etc.

Commission

They are charged for corporate cards. In the accounting records of the Commission are included in other expense and reflected in the appropriate sub-account Sch. 91.

The Amount and procedure of remuneration is to be debited shall be established in accordance with the tariffs of the banking organization. They are listed in the Annex to the service contract account.

Declining balance

If the contract service fee provided for their calculation, they are included in other income. In carrying out the transaction:

- DB midrange. 55 subsc. "Special account" KD CQ. 91 subsc. "Other income".

Nuances

The above order of reflection of operations relates principally to the companies-owners of card accounts, carrying with them the calculations with commercial partners.

However, the company may accept payment cards to individuals and organizations. Issuers (those producing cards) enter into with commercial enterprises contracts for the sale of products to cardholders.

The agreement defines the rules governing points of technical devices, authorization of the transaction, the conditions of calculations with buyers, the fee payable to the servicing Bank. The latter, as a rule, withheld from the proceeds received when selling goods and credited with the commercial enterprise.

Collection of slips

Sleep – it is a terminal check. The procedure and frequency of collection is determined in the contract signed with the Bank-acquirer (credit card company, which organizes the point of card reception and providing services for maintenance of the complex operations in them). While this is necessarily drawn the registry slips. It indicates the number of checks and total amount.

The Registry, you should fill in two copies. One together with the slip is given to the collector, the second – stays in commercial enterprise. In the latter case, the collector also gives a receipt.

As the basis for reflection of the sums of the MF. 57 is a second instance of the document. Prior to the transfer of slips to the collector of the enterprise may not consider the amount as "cash in transit". Accordingly, the reflection at the 57 account is not possible.

Prior To the transfer of slips to the Bank (while they are in the checkout commercial enterprise) funds for goods not being discarded and not transferred to R/C. Accordingly, it is considered that the buyers formed a receivable.

During the enrollment of the proceeds from the transaction was created:

- DB midrange. 51 KD CQ. 57.

Accounting corporate cards C1

The Reflection of the operations accompanied by not at present any difficulties. I must say that earlier accountingcorporate cards in 7 C1 7, for example, was done almost manually.

A Software product 1C "Accounting" is constantly being improved. The first significant change in said user program version C1 8 2. Accounting corporate cards in the new app even easier. Consider some of the nuances of transactions.

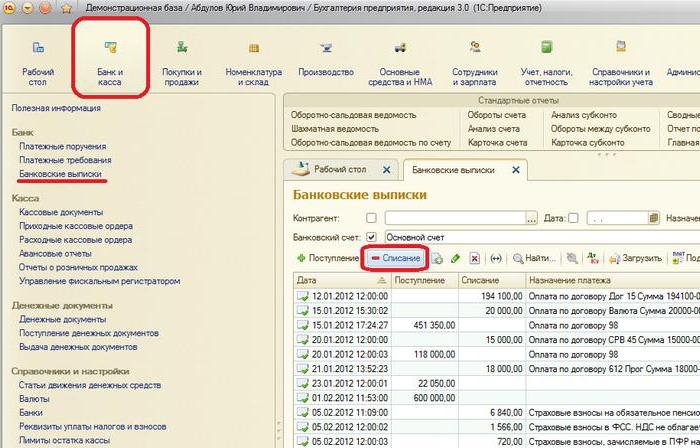

Operation popolani corporate cards in accounting in C1 8 3 is indicated by "a write-off with p/s". To open it go to "Bank and cash", then in "Bank statements" and click on "write-off".

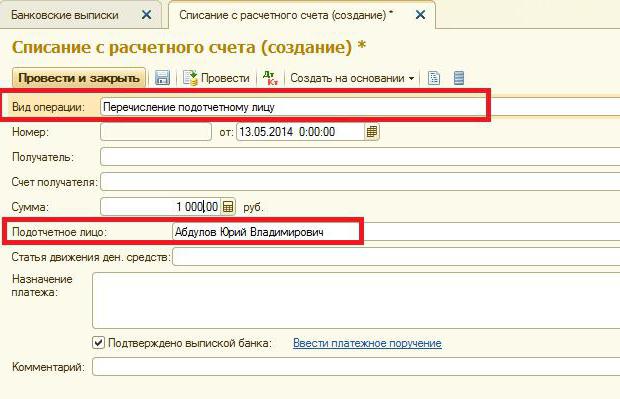

In the form of a document, you specify the transaction type "Transfer to other account". To select the beneficiary account should be opened the directory "Bank accounts". Debit article is midrange. 55.04.

In version 1C 8.2 cancellation are processed in a similar way. While the flow of funds to transfer from R/s was not made a separate document – it is accounted for as turnover movement amounts.

Cash Withdrawal at ATM

When cash is withdrawn from an employee actually takes them under report. Accordingly, it is required to provide proof of expenses.

For example, an employee cashed a certain amount from the card and paid for the purchase of inventory.

Removing in 1C is indicated by the document "write-offs with p/s". It is necessary to set the type of the transaction: "the transfer of accountable officer", the score 55.04. A Bank account is one to which the card is linked. The document also contain information about its holder, i.e. the person accountable.

Upon reflection of the operation will be composed of record:

- DB midrange. 71.01 CD CQ. 55.04.

The Bank fee will be charged when cash is withdrawn

This operation is indicated by the document "write-off with p/s". Its form – "other cancellation", account – 55.04. Is Bank account attached to the card.

In the details specified CQ. 91.02. Is debit the account to which is transferred the Commission. In the "other expenses/income" should choose an article that relates the costs of the services of the Bank. After that formed the entry:

DB midrange. 91.02 CD CQ. 55.04.

Operation expenses confirmation

IN the 1S reflection of costs is carried out using the document "expense report".

When filling in the tab "advance" must be set to "write-off with p/s".

In the tab "Products" you must fill in information about purchased commodity-material values, their expense and VAT.

Article in other languages:

AR: https://www.tostpost.com/ar/finance/19333-accounting-corporate-cards-settlement-procedure.html

HI: https://www.tostpost.com/hi/finance/21003-accounting-corporate-cards-settlement-procedure.html

JA: https://www.tostpost.com/ja/finance/18958-accounting-corporate-cards-settlement-procedure.html

PL: https://www.tostpost.com/pl/finanse/38357-rachunkowo-korporacyjnych-kart-kolejno-oblicze.html

TR: https://www.tostpost.com/tr/maliye/33495-muhasebe-kurumsal-kart-yeniden-hesaplama.html

ZH: https://www.tostpost.com/zh/finance/30923-accounting-corporate-cards-settlement-procedure.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Plastic Bank: how to know the account number of the card

it is very likely that before any of us the question may arise, how to know the account number of the card? It was pretty big. After all, almost every citizen owns at least one credit card: payroll, credit, co-brand, gift, corpora...

Organization of accounting at the enterprise taking into account environmental activities

the result of the analysis accounting for environmental performance of a number of enterprises often identifies the main shortcomings and problems faced by the existing system of accounting: 1) the inconsistency value to pay ...

How to get a loan at Sberbank of Russia

Continuous improvement of banking products and simplification in the system of service has allowed Sberbank to become the leader in loans to individuals and legal entities. The simplicity of the design, acceptable interest rates a...

LCD "Kalina-Park". "Kalina-Park": how to get the characteristics of the homes and reviews

At a distance of over 1300 kilometers from Moscow and about 100-120 kilometers away from the Black and Azov seas freely stretched under the hot southern sun city of Krasnodar. The population increase rapidly, so the city is very a...

currently, an important issue was how to be filled tax Declaration for land tax. It is also important to know who is responsible for payment of taxes. Interesting this caveat: who delivers the Declaration on land tax mandatory? Al...

Average wages in Belarus for workers and employees

the Republic of Belarus, one of the most prosperous States in Eastern Europe, has a population of 9 million 460 thousand people. It shares borders with Ukraine to the South, Russia to the East, Poland to the West, and Lithuania an...

Comments (0)

This article has no comment, be the first!